The Impact of Cryptocurrency on the World

Introduction

Cryptocurrency, a digital or virtual currency that uses cryptography for security, has emerged as a revolutionary force in the global economy. Bitcoin, the first and most well-known cryptocurrency, was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. Since then, thousands of alternative cryptocurrencies have been developed. This article explores how cryptocurrency is affecting the world in various domains, including finance, technology, regulation, and society.

The Financial Impact of Cryptocurrency

Decentralization of Finance

One of the most significant impacts of cryptocurrency is the decentralization of finance. Traditional financial systems rely on centralized authorities, such as banks and governments, to regulate and facilitate transactions. Cryptocurrencies, on the other hand, operate on decentralized networks based on blockchain technology. This shift reduces the reliance on intermediaries, potentially lowering transaction costs and increasing access to financial services, especially in underserved regions.

Financial Inclusion

Cryptocurrencies have the potential to provide financial services to the unbanked and underbanked populations. According to the World Bank, approximately 1.7 billion adults worldwide do not have access to a bank account. Cryptocurrencies can offer an alternative to traditional banking by allowing individuals to store and transfer value using a smartphone. This can be particularly impactful in developing countries where access to banking infrastructure is limited.

Investment and Speculation

The rise of cryptocurrencies has created new opportunities for investment and speculation. Bitcoin and other cryptocurrencies have attracted significant attention from investors looking for high returns. The volatility of cryptocurrency prices has led to substantial gains for some investors, but it has also resulted in significant losses for others. This speculative nature of cryptocurrency markets has raised concerns about market stability and investor protection.

Technological Advancements

Blockchain Technology

At the core of cryptocurrency is blockchain technology, a decentralized ledger that records all transactions across a network of computers. This technology has far-reaching implications beyond digital currencies. Blockchain can be used to enhance transparency, security, and efficiency in various industries, including supply chain management, healthcare, and voting systems. The immutability and transparency of blockchain make it a valuable tool for combating fraud and ensuring data integrity.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute and enforce the terms of the contract when predefined conditions are met. Cryptocurrencies like Ethereum have popularized the use of smart contracts, enabling decentralized applications (dApps) that can operate without intermediaries. This innovation has the potential to disrupt traditional legal and business practices by reducing the need for third-party arbitration and streamlining processes.

Decentralized Finance (DeFi)

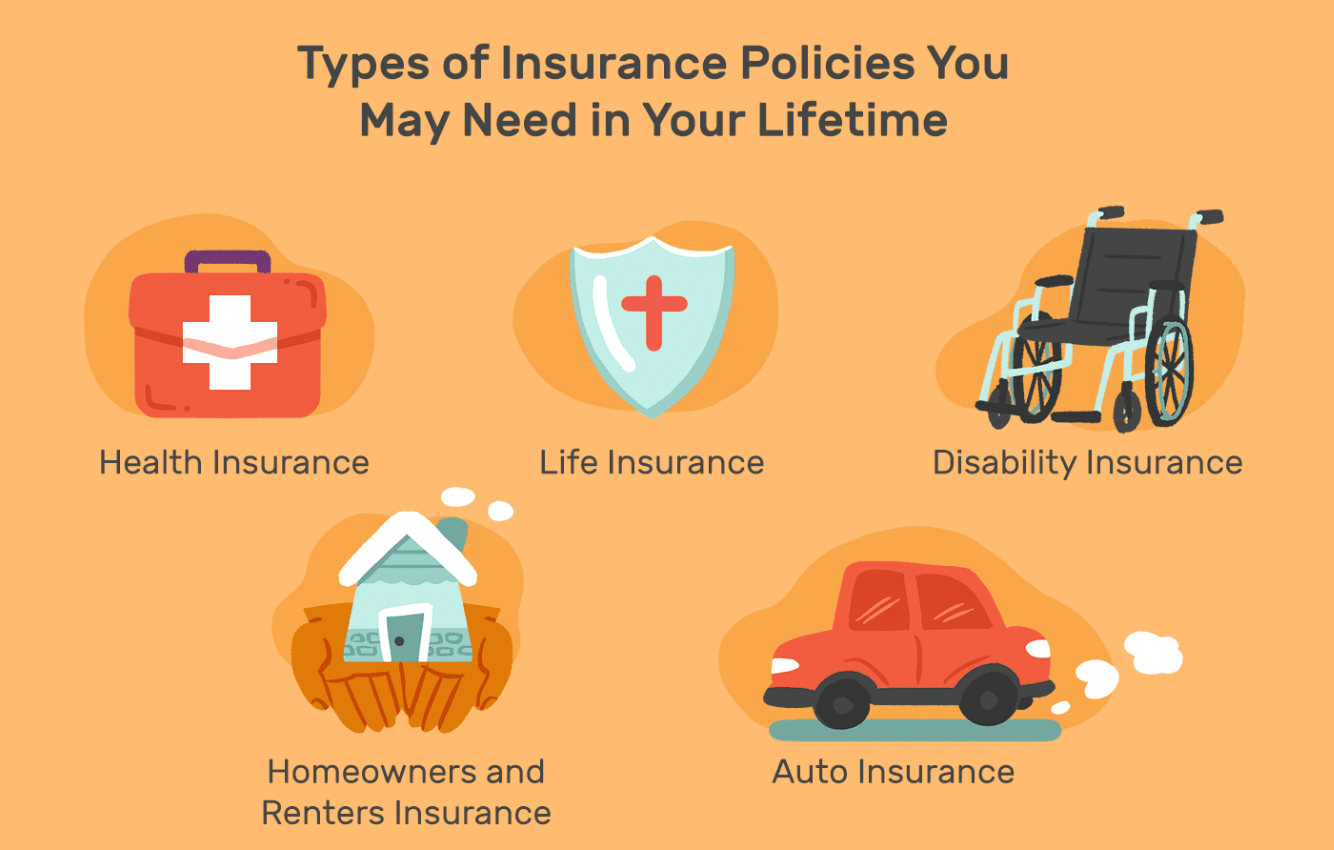

Decentralized Finance, or DeFi, refers to a suite of financial applications built on blockchain technology that aims to recreate traditional financial systems in a decentralized manner. DeFi platforms offer services such as lending, borrowing, trading, and insurance without the need for intermediaries. This can lead to greater financial transparency, reduced costs, and increased access to financial services. However, DeFi also comes with risks, including smart contract vulnerabilities and regulatory challenges.

Regulatory Challenges and Responses

Government Regulation

The rise of cryptocurrencies has posed significant challenges for regulators worldwide. Governments are grappling with how to regulate this new asset class while balancing the need to protect investors, prevent illicit activities, and foster innovation. Regulatory approaches vary widely across countries. Some, like Japan and Switzerland, have embraced cryptocurrencies and established clear regulatory frameworks, while others, like China and India, have imposed strict bans or restrictions.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

Cryptocurrencies have been associated with money laundering and other illicit activities due to their pseudonymous nature. To address these concerns, many countries have implemented Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements for cryptocurrency exchanges and service providers. These regulations aim to prevent the misuse of cryptocurrencies for illegal purposes by ensuring that transactions can be traced and that users’ identities are verified.

Taxation

Tax treatment of cryptocurrencies varies by jurisdiction and can be complex. Some countries classify cryptocurrencies as property, subjecting them to capital gains tax, while others treat them as currency or commodities. The lack of uniformity in tax regulations can create challenges for individuals and businesses dealing with cryptocurrencies, particularly when engaging in cross-border transactions.

Social and Cultural Impact

Financial Sovereignty

Cryptocurrencies have empowered individuals to take greater control over their financial lives. By providing an alternative to traditional banking systems, cryptocurrencies enable users to store and transfer value without relying on intermediaries. This financial sovereignty is particularly appealing to those who distrust traditional financial institutions or live in countries with unstable currencies and restrictive capital controls.

Adoption and Awareness

The adoption of cryptocurrencies is growing, driven by increasing awareness and acceptance. High-profile endorsements and investments by companies like Tesla and Square have brought cryptocurrencies into the mainstream. Additionally, the rise of cryptocurrency ATMs, payment processors, and online merchants accepting cryptocurrencies has made it easier for individuals to use digital currencies in everyday transactions.

Community and Culture

The cryptocurrency community is diverse and vibrant, comprising developers, investors, enthusiasts, and advocates. This community has fostered a culture of innovation, collaboration, and activism. Cryptocurrencies have given rise to new forms of organization, such as Decentralized Autonomous Organizations (DAOs), which operate on blockchain technology and enable collective decision-making and resource management.

Environmental Concerns

Energy Consumption

One of the major criticisms of cryptocurrencies, particularly Bitcoin, is their environmental impact. The process of mining, which involves solving complex mathematical problems to validate transactions and secure the network, requires significant computational power and energy. Bitcoin mining is estimated to consume more energy than some entire countries, raising concerns about its sustainability and environmental footprint.

Sustainable Solutions

In response to environmental concerns, there is a growing focus on developing more sustainable cryptocurrency practices. Some cryptocurrencies, such as Ethereum, are transitioning from energy-intensive proof-of-work (PoW) consensus mechanisms to more energy-efficient proof-of-stake (PoS) systems. Additionally, renewable energy sources and innovative mining technologies are being explored to reduce the environmental impact of cryptocurrency mining.

Economic Implications

Market Volatility

Cryptocurrency markets are known for their extreme volatility. While this can present opportunities for substantial gains, it also poses risks for investors and can contribute to market instability. The high volatility of cryptocurrencies can impact broader financial markets and investor sentiment, highlighting the need for regulatory oversight and risk management strategies.

Disruption of Traditional Financial Institutions

The rise of cryptocurrencies and blockchain technology has the potential to disrupt traditional financial institutions. Banks, payment processors, and other financial intermediaries may face increased competition from decentralized financial platforms and services. This disruption could lead to changes in business models, cost structures, and the competitive landscape of the financial industry.

Cross-Border Transactions

Cryptocurrencies facilitate cross-border transactions by providing a fast, secure, and cost-effective alternative to traditional methods. This can be particularly beneficial for remittances, international trade, and global business operations. By reducing the need for currency exchange and lowering transaction fees, cryptocurrencies can enhance the efficiency of cross-border financial activities.

Legal and Ethical Considerations

Legal Status and Recognition

The legal status and recognition of cryptocurrencies vary significantly across jurisdictions. Some countries have embraced cryptocurrencies and established regulatory frameworks, while others have imposed bans or restrictions. The lack of uniformity in legal treatment can create challenges for individuals and businesses dealing with cryptocurrencies, particularly in terms of compliance and legal certainty.

Consumer Protection

Consumer protection is a critical issue in the cryptocurrency space. The pseudonymous nature of cryptocurrencies can make it difficult to trace and recover lost or stolen funds. Additionally, the lack of regulation and oversight in some areas can expose consumers to fraud, scams, and market manipulation. Regulatory frameworks and industry standards are needed to enhance consumer protection and build trust in the cryptocurrency ecosystem.

Ethical Considerations

The ethical implications of cryptocurrency use are complex and multifaceted. While cryptocurrencies can promote financial inclusion and sovereignty, they can also be used for illicit activities such as money laundering, tax evasion, and funding illegal operations. Balancing the positive and negative aspects of cryptocurrency use requires careful consideration of ethical principles and regulatory measures.

Future Prospects and Trends

Mainstream Adoption

The future of cryptocurrency will likely see increased mainstream adoption as awareness and acceptance continue to grow. Major financial institutions, technology companies, and governments are exploring ways to integrate cryptocurrencies into their operations and services. This trend is expected to drive innovation, investment, and regulatory developments in the cryptocurrency space.

Technological Innovations

Technological innovations will continue to shape the evolution of cryptocurrencies. Advances in blockchain technology, scalability solutions, and interoperability protocols will enhance the functionality and efficiency of cryptocurrencies. Additionally, emerging technologies such as quantum computing and artificial intelligence may impact the security and operation of cryptocurrency networks.

Regulatory Evolution

Regulatory frameworks for cryptocurrencies are likely to evolve in response to market developments and emerging risks. Governments and regulatory bodies will need to strike a balance between fostering innovation and ensuring investor protection, market stability, and financial integrity. International cooperation and harmonization of regulations may be necessary to address the global nature of cryptocurrency markets.

Integration with Traditional Finance

The integration of cryptocurrencies with traditional financial systems is expected to accelerate. Central banks are exploring the development of Central Bank Digital Currencies (CBDCs), which could coexist with cryptocurrencies and provide a bridge between traditional and digital financial systems. Collaboration between traditional financial institutions and cryptocurrency platforms may also lead to the development of hybrid financial products and services.

Conclusion

Cryptocurrency is a transformative force with the potential to reshape the global economy and financial systems. Its impact is multifaceted, affecting various aspects of finance, technology, regulation, and society. While cryptocurrencies offer numerous benefits, including financial inclusion, decentralization, and technological innovation, they also pose challenges and risks that need to be addressed through regulatory oversight, consumer protection, and sustainable practices. As the cryptocurrency landscape continues to evolve, its influence on the world will undoubtedly grow, shaping the future of finance and beyond.

Post Comment